外文原文

Determinants of Non Performing Loans in Commercial Banks: A Study of NBC Bank Dodoma Tanzania

Introduction

Banks play an important role in the economic development of a country. Borrowers and lenders have different liquidity preferences. Banks pool funds together and make them available for investments via issuing loans, thereby providing liquidity. Small business borrowers find bank lending important due to their small sizes and capacities. Finding funds through public markets is virtually impossible, because banks build relationships with customers that give them valuable information about their operations. Enhanced bank–customer relationship helps small business to access funding, because the bank has got special knowledge about the firm.

Banks have to follow the principle of diversification of risk. Banks must also have good loan policy. The loan policy of a bank must be definite and board-based so that credit officers may not face any problem in evaluating the credit worthiness of loan applicants. The lending policy should prescribe specific guidelines with respect to such items as: loan territory, types of loans to be made, acceptable securities, lending criteria, loan liquidation, loan commitment, and loan authority of credit officials. (Ritu, 2012).

However, the level of bad and doubtful debt provision of banks operating in Tanzania has increased significantly over the past few years in monetary terms and also as percentage of non- performing loans. The ratio of non- performing loans to total loans inyear 2007 was 6 percent, in year 2008 it was 6.5 percent, and in year 2009 it was 7 percent. (Mutarubkwa,2011). The possible causes of non- performing loans are both internal and external factors.

One common feature about banking business is that, it is a homogenous type of business where products offered are almost similar except for the interest rates and quality of services. Thus due to the non- performing loans a bank can fail and this can trigger other banks to fail due to the relationship which exists between them. This happens because bank customers may think that their banks also have similar problems like the one in trouble, therefore, this may create fear in them and force them to withdraw their funds creating liquidity problems to the failing bank. Additionally, as the failing bank struggles to stay afloat it may call for its outstanding loans and refuse to make new loans. This may create what is known as a “credit crunch” and hence contribute to depression of the economy. Ireland, Greece, Spain, and Italy are all haunted by non –performing loans. Tanzania’s experience shows that many banks are suffering from non- performing loans. NBC is one bank which is facing this problem .According to NBC’s financial report (2012), the percentage of non- performing loans in year 2010 was 14 percent, and in year 2011, it was 16 percent. There is a need, therefore, to identify factors that hinderloan repaymentin banks, and this move will help prevent banks from furthergetting hurt.

Literature Review

Over the last few years the literature that examines poor loan has expanded in line with the interest afforded to understanding the factors that hinder loan repayment. This is because it is widely accepted that the percentage of loan losses is often associated with bank failures and financial crises in both developing and developed countries. Therefore, this section reviews existing literature so as to formulate a theoretical framework to investigate the determinants of loan repayments in NBC.

Oladeebo and Oladeebo (2008) conducted research on factors affecting loan repayment among small holder farmers in Ogbomoso agricultural zone of Oyo state in Nigeria. They found evidence that amount of loan collected, age experience with credit usage, and level of education were major significant socio-economic factors determining loan repayment.

Several studies which followed the publication of Din’ohi have proposed similar explanations for problematic loans in Tanzania. For instance Mwakoba (2011) studied determinants of non- performing loans at SACCOS,and found strong association between non-performing loans and high interest rate, insufficient collateral and business problems. More recently Kwayu (2011) analyzed factors for non- repayment of bank loans at NBC Dodoma region. She argued that interest rate does not affect repayment of loans, but costs incurred during loans application are high. The attitudes of borrowers contributed to non-repayment of loans. Other reasons for poor repayment of loans were bad economic condition and high competition.

Methodology

This research was conducted at NBC Dodoma main branch , Tanzania. This is because NBC is situated in a region where conditions are ripe for banks to perform profitably because many houses are being constructed, and also more academic institutions and businesses are being established, therefore creating more demands for loans. But this increase in demand for loans has led to increase in percentage of non-performing loans. From year 2008 to 2012 many banks such as Barclays, DTB , NBC, and some other banks have opened new branches in Dodoma and creating a very competitive environment.

Application of the Model

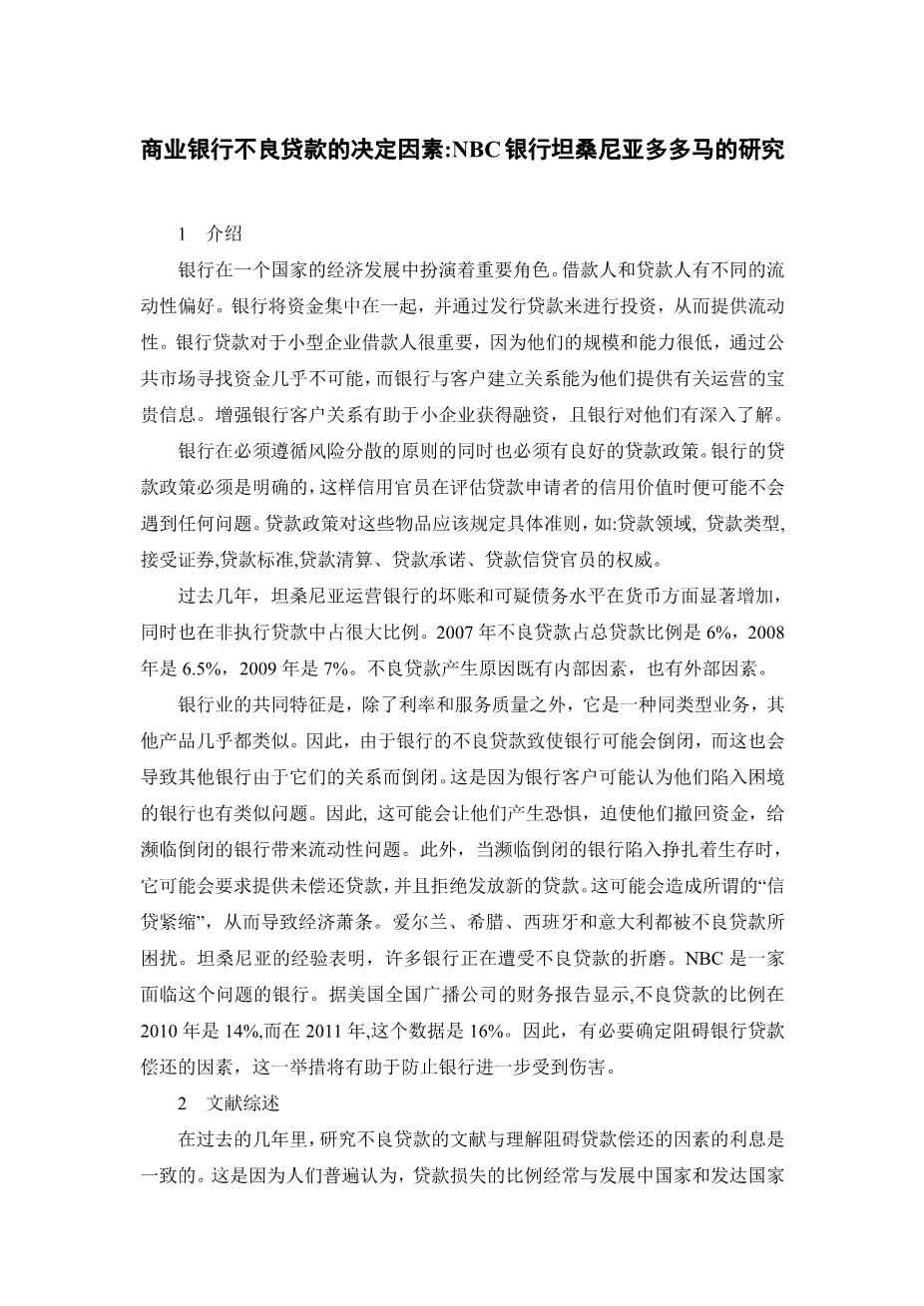

The respondents responses with regard to the question Did you have any source of credit other than the one from NBC was that all respondents (100%) agreed they did not have any source of credit other than from NBC. Also, the respondent’s responses with regard to whether the repayment period set by NBC is suitable are summarized and presented in next table

Table 5.3.1: Repayment period

Repayment period suitable | Frequency | Percent</ 剩余内容已隐藏,支付完成后下载完整资料

英语译文共 4 页,剩余内容已隐藏,支付完成后下载完整资料 资料编号:[486520],资料为PDF文档或Word文档,PDF文档可免费转换为Word 原文和译文剩余内容已隐藏,您需要先支付 30元 才能查看原文和译文全部内容!立即支付

以上是毕业论文外文翻译,课题毕业论文、任务书、文献综述、开题报告、程序设计、图纸设计等资料可联系客服协助查找。 |